Picture supply: Getty Pictures

Thousands and thousands of us make investments for passive revenue. Nonetheless, most don’t know the place to begin. That’s particularly the case for these of us with out something saved.

So the place does an investor start, particularly with no nest egg at age 30? The reply, as ever, is deceptively easy. Begin placing apart a portion of wage every month.

Even when the quantity feels modest at first — maybe £100 or £200, no matter is manageable — the bottom line is consistency. By treating financial savings as a non-negotiable expense, akin to lease or council tax, a basis’s created for a future portfolio that works independently.

Compounding magic

However right here’s the actual magic: compounding. That is the quiet power that transforms small, common investments into substantial wealth over time. And that’s vital. As a result of we want substantial wealth with a purpose to earn a passive revenue.

For instance, if £200 is invested every month from age 30, and a mean annual return of 5% is achieved, by age 65 the ensuing pot could possibly be nicely into six figures. Nonetheless, extra profitable traders could possibly common double-digit returns over the interval.

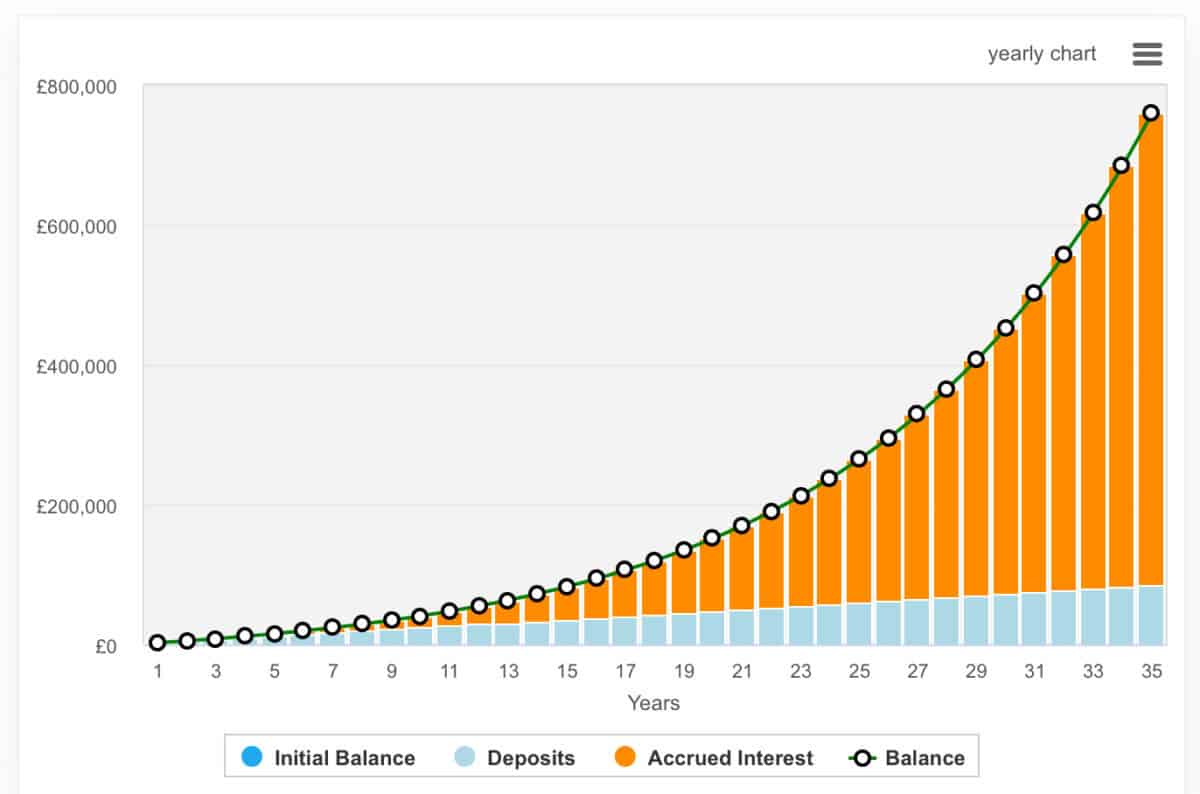

As we will see from the beneath chart, £200 a month might compound into practically £800,000 with 10% annualised progress (which not everybody will be capable of obtain).

The sooner the beginning, the extra highly effective compounding turns into. Contemplate two hypothetical traders: one begins at 30, the opposite waits till 40 however doubles the month-to-month contribution. Regardless of placing in extra money, the late starter’s unlikely to catch up, just because the early chook’s cash has had extra time to snowball.

Reinvesting dividends is one other essential lever. Quite than taking payouts as money, dividends have to be ploughed again into holdings. This creates a virtuous cycle that accelerates progress.

Above all, persistence is the best ally. The urge to tinker or chase fads could be ignored. Time and compounding do the heavy lifting.

The place to take a position?

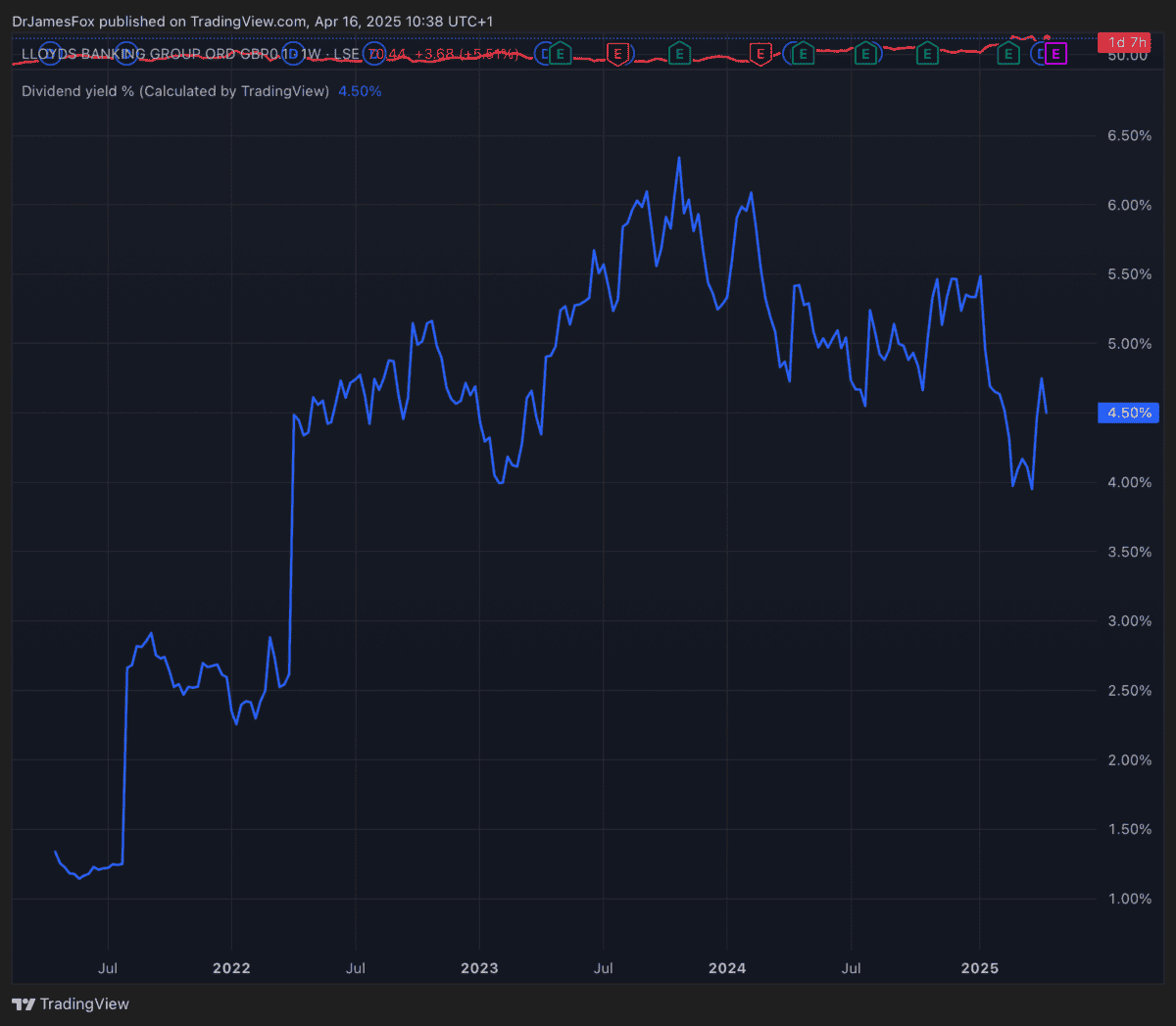

Let’s be sensible and never assume a ten% return. One possibility that could possibly be thought-about as a part of a various portfolio over the subsequent 35 years is Lloyds (LSE:LLOY). The British lender provides a mix of revenue and worth for traders looking for publicity to the banking sector. Regardless of current volatility, together with the motor finance mis-selling probe, Lloyds is resilient with robust capital buffers and a progressive dividend coverage.

Trying forward, Lloyds’ ahead earnings are forecast to enhance. Earnings per share (EPS) are projected at 6.5p in 2025, rising to eight.85p in 2026 and 10.68p in 2027.

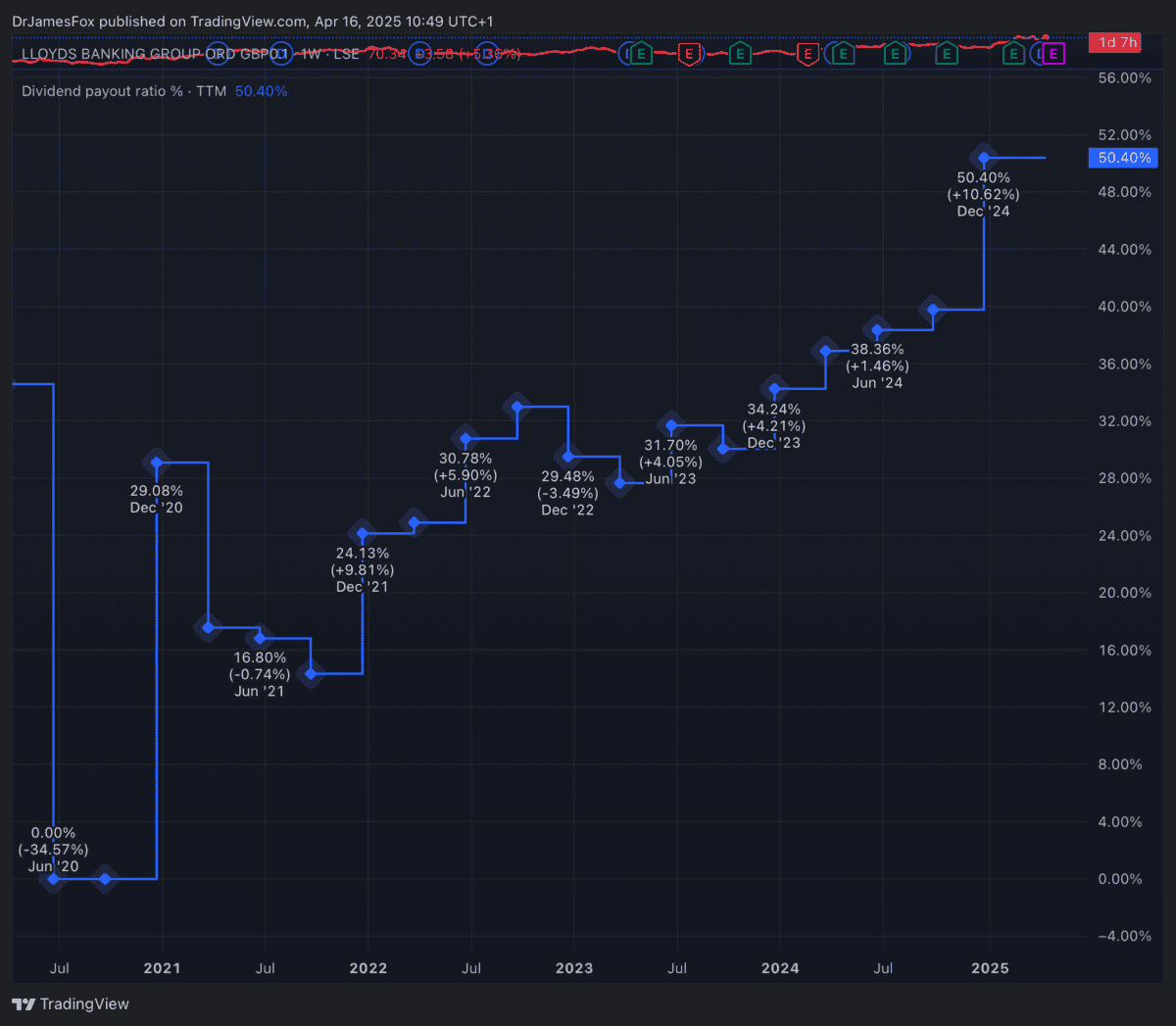

As such, the ahead price-to-earnings (P/E) ratio’s anticipated to say no from 10.9 instances in 2025 to eight instances in 2026 and 6.6 instances in 2027. Dividends are additionally set to develop, with forecasts of three.44p per share in 2025, 4.07p in 2026, and 4.64p in 2027, translating to yields between 4.9% and 6.6%.

What’s extra, the payout ratio stay sustainable.

Dangers persist, in fact. The UK financial system might face a slowdown due to US tariffs, and this actually isn’t good for banks, which generally replicate the well being of the financial system. Nonetheless, it’s nonetheless an attention-grabbing proposition. Personally, I’m simply holding on to my Lloyds shares, moderately than shopping for extra, attributable to focus danger.