Wallets have lengthy been the punching bag of crypto. Their poor UX carries the blame for crypto’s lack of ability to interrupt additional into the mainstream. No one has a favourite pockets – solely the one which annoys them the least. The issue lies with the complexity of blockchains and managing non-public keys. After years of improvement, that is slowly altering with the upcoming big improve within the Pectra Hard Fork. Beneath, Denis & I take a look at what’s to return, and the implications for market and energy constructions inside a thriving pockets trade.

– Chris

The crypto consumer expertise (UX) has traditionally been poor, with people dropping funds, choosing centralized options, or leaving the house altogether.

There have been two key efforts to boost DeFi UX. First, by way of centralized options that supply a white-glove model of DeFi. The DeFi Mullet is a world the place onchain protocols are used, however most customers depend on centralized companies like Coinbase to carry their keys and management their funds (best exemplified by the Coinbase integration of DeFi lending protocol Morpho). The second is by way of a world that fulfills the unique crypto imaginative and prescient, the place self-custody is utilized by the plenty and crypto wallets are ubiquitous.

DeFi energy customers – responsible as charged – are keen to place up with the clunkiness as a result of they need the liberty to discover each inch of the blockchain. However an everyday consumer doesn’t need something to do with non-public keys.

Crypto wallets have lengthy disillusioned; each cycle guarantees a greater pockets design to lastly unlock mainstream adoption. This time, the hype could be warranted. Or no less than, it is a final shot earlier than the centralized companies begin driving onchain product improvement.

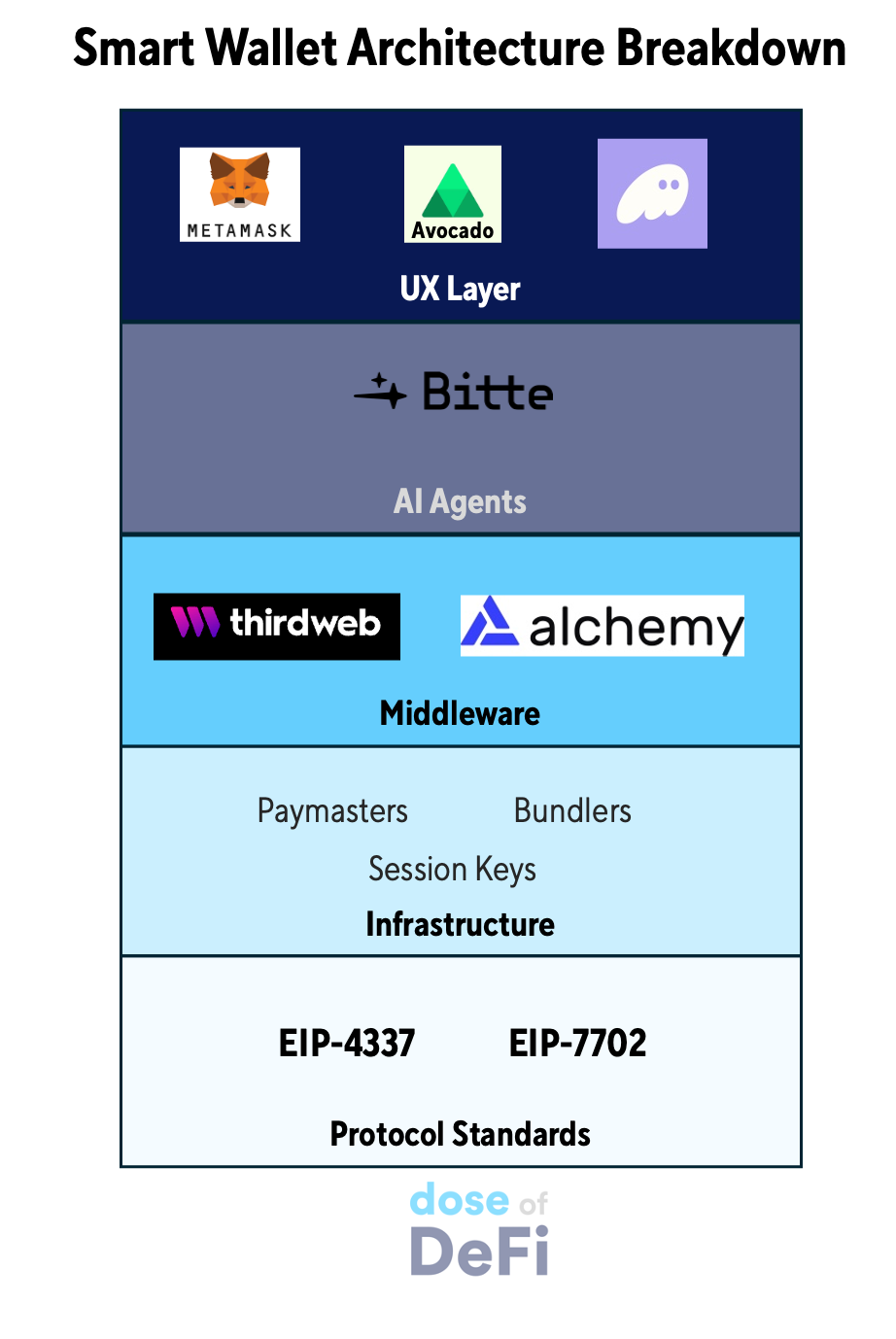

With the upcoming Pectra Onerous Fork on Ethereum (introducing EIP-7702) and contemporary income fashions (from in-app swaps to MEV move offers), wallets are evolving from clunky key-management instruments into refined ‘orchestration layers’.

On this piece, we’ll discover how EIP-7702 builds on latest upgrades (i.e. EIP-4337), which wallets are finest positioned to capitalize on user-friendly options, and why these adjustments might lastly lead wallet-UX to satisfy its promise of self-custody.

Efforts to boost UX in crypto have been progressing just lately. As mentioned in our article titled Abstract away! The race towards interoperability, the newest vital improve to Ethereum (EIP-4337) went stay in 2024. Now, market consideration has shifted to EIP-7702, which is ready to launch with the upcoming Pectra Hard Fork. In different phrases, an opportune second to debate its implications. The important thing one being that, with this new infrastructure in place, we’re lastly outfitted to construct consumer experiences that may strategy Web2 usability – whereas preserving the core ideas of Web3.

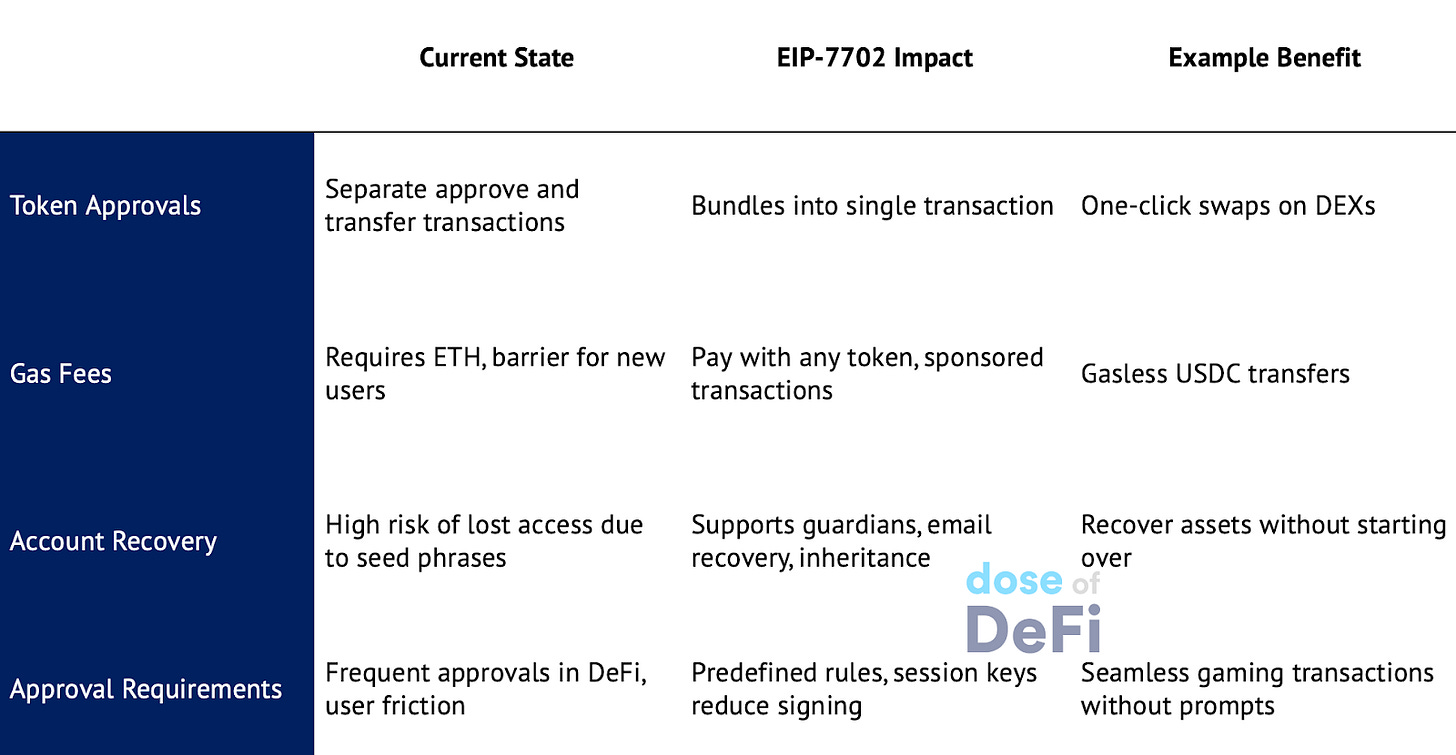

EIP-7702 will significantly alter how Ethereum accounts operate. Listed below are some notable enhancements that will probably be made to present externally owned accounts (EOAs), the default account sort:

-

No extra token approvals: Approvals and swaps will probably be bundled right into a one-click expertise, as an alternative of the clunky present one. Going ahead, an EOA can delegate to a sensible contract that executes each the approve and transferFrom steps in a single transaction. Bundling additionally permits extra environment friendly execution of advanced DeFi methods with out requiring particular person transaction signatures.

-

Gasoline abstraction: Customers will be capable to pay gas fees with any token, profit from sponsored transactions (the place an utility or pockets covers gasoline prices), and make the most of cross-chain gasoline funds. Presently, customers should purchase ETH or SOL to ship USDC – think about having to purchase Federal Reserve inventory simply to wire {dollars}.

-

Account restoration: Relying on the pockets supplier, restoration choices reminiscent of guardians, email-based restoration, and legacy/inheritance options will probably be launched. Many crypto customers have misplaced tokens by misplacing their seed phrases.

-

Much less signing: Customers will be capable to set predefined guidelines for interacting with decentralized functions, offering restricted entry with out requiring fixed approvals. With EIP-7702, customers can create session keys to assist mitigate the related friction by permitting customers to pre-authorize interactions, lowering the necessity for extreme signing.

Regardless of the advantages, the velocity at which EIP-7702-based wallets will probably be adopted is unsure. One factor about wallets is that customers are sticky – and merchandise are sluggish to implement new options. For Dapps, this creates twice the complexity: two consumer journeys, two separate interfaces – nearly like constructing two distinct merchandise. Because of this, there’s little fast motivation for Dapps to spend money on devoted account abstraction experiences, and customers have little purpose to undertake good accounts in the event that they don’t noticeably enhance their Web3 expertise.

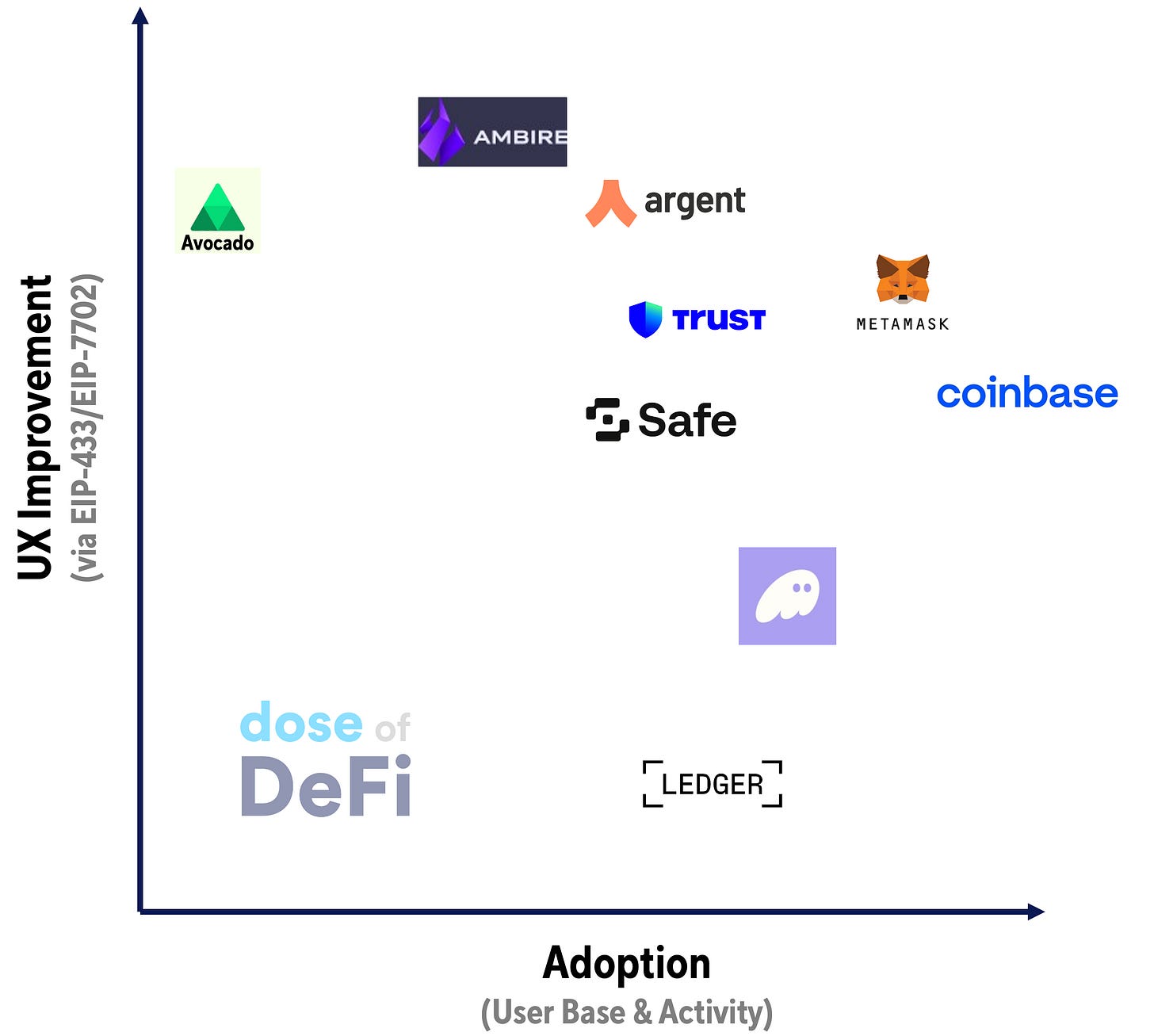

Ambire, Argent and Avocado are among the many first wallets so as to add EIP-4337-based good contracts. Within the developer instruments house, Thirdweb and Alchemy supply SDKs and APIs that make it straightforward for builders to embed EIP-4337-compliant good wallets into dApps, accelerating adoption.

In 2024, EIP-4337 good accounts noticed huge development, with over 103 million Person Operations – a greater than tenfold enhance from 2023. (Facet be aware: UserOps are a brand new consumer transaction sort after the EIP-4337 replace). Nonetheless, most accounts have been single-use, pushed by apps providing sign-up rewards, whereas just a few apps, like Blocklords and OpenSocial, succeeded in driving repeat engagement. Notably, 87% of UserOps charges have been lined by Paymasters, making transactions cheaper for customers. General, EIP-4337 adoption expanded throughout a number of chains and use instances, particularly gaming and social apps (although retaining lively customers stays a problem). Nonetheless, ERC-4337 bundle transactions represented solely about 1.5% of complete ETH + L2 ecosystem transactions in 2024.

One crucial side lacking from the wallet-UX-upgrade motion is privateness. Vitalik Buterin recently emphasised that privateness stays an unresolved challenge in crypto. Privateness-focused cryptocurrency Monero, regardless of its gifted developer crew and vital monetary assets, has never achieved mainstream adoption. Whereas the removing of Twister Money from the OFAC sanctions record is a optimistic improvement, the blockchain neighborhood – together with the Ethereum Foundation – has but to prioritize privateness enhancements on the Layer 1 degree. In his December article, Vitalik poses some short-term privateness options based mostly on wallets, a few of that are being applied in Zupass. Nonetheless, to have a correct long-term resolution, these enhancements have to be applied on the base chain or utility layer, like the recent launch of PrivacyPools.com.

Exterior of the infrastructure enhancements, wallets may additionally see enhancements with the rise of AI. Bitte.ai is pioneering AI-driven automation by embedding AI brokers straight into DeFi functions. As a substitute of conventional point-and-click interfaces, Bitte’s system employs chat-based interactions, the place AI assistants information customers, execute transactions, and handle DeFi actions.

Initiatives reminiscent of Bitte enable customers to enter pure language instructions (e.g., “Swap X ETH for X USDC on chain X,” “Deposit to Spark,” “Send 0.5 ETH to Mom”). AI then determines the optimum route, constructs the transaction, and presents it for affirmation. This text-based strategy improves usability by consolidating a number of DeFi protocols inside a single interface. To reinforce safety, AI analyzes consumer habits and introduces further affirmation steps for suspicious exercise.

One of many biggest advantages of the shift to AI-driven or chat-based UX is the rise of intent protocols. As we previously mentioned, intents characterize a consumer expressing their desired end result in a transaction request. This strategy removes pointless constraints on how the request is executed, focusing as an alternative on the meant consequence. Specialised actors often called ‘solvers’ then compete to determine essentially the most cost-efficient option to fulfill a consumer’s intent.

So to recap, wallets will profit from main infrastructure upgrades on Ethereum with 7702. And with this, be capable to wield AI of their endless battle to summary away the complexity of blockchain transactions.

For many of crypto’s historical past, wallets were critical infrastructure with no business model. They sat closest to the consumer however struggled to seize worth, serving as UI layers that have been costly to construct and keep, but difficult to monetize. That is now modified. Immediately, wallets are quietly turning into worthwhile. MetaMask generates $50 million+ through in-app swaps. Phantom simply raised at a $3 billion valuation with a reported $90 million in annualized revenue. Many wallets now monetize order flow or capture MEV — much like how Robinhood monetizes retail move in conventional finance.

Wallets have at all times been alluring to traders, however by no means sustained the funding required to make them client merchandise. With a extra predictable income stream, traders and corporations will certainly be extra keen to dump assets into advertising and consumer acquisition for wallets.

These adjustments carry main enterprise implications. Immediately, customers should manually choose a blockchain, including pointless complexity. Sooner or later, intermediaries will automate this course of based mostly on safety preferences (e.g., institutional traders favoring extremely safe chains) or particular consumer targets (e.g., selecting a series that helps a specific DeFi protocol).

Entities that implement this choice – reminiscent of wallets and intent protocols – might develop into the dominant distribution channels, successfully controlling the consumer relationship. This shift would profit danger managers like Gauntlet and Block Analitica, in addition to danger evaluation frameworks like L2Beat. This might then affect which chains and protocols AI defaults to as ‘preferred’ choices. By default, property could also be allotted to safer networks reminiscent of Ethereum or Stage 1 L2s like Arbitrum and OP (as categorized by L2Beat), whereas superior customers might go for riskier options, together with Stage 0 L2s.

Nonetheless, this development might face pushback from L1 and L2 chains, because it dangers commoditizing them. L1s and L2s are among the many most well-funded and deeply entrenched gamers within the trade, making the aggressive dynamics unpredictable. Uniswap has already launched its personal blockchain and later launched a pockets, so is prone to keep management over its consumer relationship. In the meantime, we see ‘Ethereum-aligned’ wallets like MetaMask directing visitors towards Ethereum and its L2s. But as MetaMask adapts to market demand by integrating Solana, one should ask: will the Ethereum Basis have to launch its personal ‘Ethereum Wallet’ to defend its moat?

Wallets now have the upgrades, enterprise fashions, and AI-driven UX to push DeFi in direction of the mainstream. Nonetheless, there’s no assure of a purely self-custodial future.

On one hand, the DeFi Mullet isn’t prone to go wherever: centralized platforms already dominate onboarding and may merely fold in onchain back-ends for these wanting ‘crypto under the hood’ with out key-management hassles. On the opposite, EIP-7702 and ‘wallet-as-orchestrator’ fashions give self-custody its finest shot but. If pockets suppliers pair account abstraction, AI-driven interfaces, and new income streams (like MEV move offers) to fund innovation, they might lastly overcome the clunky UX that has deterred on a regular basis customers.

We’ve got good purpose to need self-custodial wallets to succeed. They uphold crypto’s founding precept of decentralization and forestall lock-in. If extensively adopted, user-controlled wallets would imply no single platform can maintain funds hostage or dictate the principles.

Whether or not these paths merge, coexist, or collide remains to be to be seen – and the deciding elements go effectively past consumer interfaces. As we explored in DeFi splits in two within the fall, rules, liquidity fragmentation, and protocol governance additionally push DeFi in divergent instructions. Within the close to time period, we may even see the DeFi Mullet thrive with newcomers in search of simplicity, whereas extra superior or privacy-conscious customers embrace the brand new wave of highly effective, user-friendly self-custody.

If that latter group can ship a ‘just works’ expertise to rival centralized apps, they might fulfill crypto’s authentic imaginative and prescient. But when key-management complexities stay unsolved, custodial giants will stay the face of DeFi. A technique or one other, wallets are actually finest positioned to resolve which model of ‘financial freedom’ wins out – and the way decentralized the way forward for DeFi will probably be.

-

Aave integrates Chainlink SVR on Ethereum for liquidation MEV recapture Link

-

CowAMM suffers small exploit exploit Link

-

Rath Finance launches new DeFi rails for yield packaging Link

-

Hydro crew develops new strategy to impermanent loss Link

-

Compound Labs reemerges, toys with launching Compound Basis Link

-

DeFi revenues decline in March as onchain exercise slows Link

-

AtlasEVM introduces common public sale system for transaction execution Link

-

Matcha expands to Solana with SVM and EVM chain assist Link

That’s it! Suggestions appreciated. Simply hit reply. Nonetheless into this meme: open-source capitalism.

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov, Zhev and Financial Content Lab. All content material is for informational functions and isn’t meant as funding recommendation.