Maker (MKR) seems to be strengthening its market rally and is at present experiencing growing investor consideration and bullish market sentiment. Whales are displaying strong curiosity within the asset as reported by Lookonchain at present.

Whale provides 2,827 MKR

At present, a whale spent $4 million in DAI stablecoin to buy 2,827 Maker at a median price of $1,415. This important acquisition of MKR tokens exhibits the curiosity and optimism of savvy buyers.

The transaction exercise means that whales and long-term holders might seize the chance to amass MKR tokens. It signifies that MKR is going through elevated demand. Such large purchases usually lower promoting strain, trace at possible upward momentum, and recommend a super shopping for alternative.

Maker price updates

Maker has not too long ago displayed an excellent restoration after witnessing a downtrend over the previous two weeks. As of at present, April 10, 2025, the asset stands at $1,321, representing an unbelievable 6.6% surge within the final 24 hours. Its buying and selling quantity additionally recorded a rise of 43.60% over the interval, indicating that buyers and merchants are displaying elevated curiosity within the asset. Moreover at present’s improve, its price has been up 2.4% over the previous week. These inexperienced figures recommend a chance of a bullish momentum continuation.

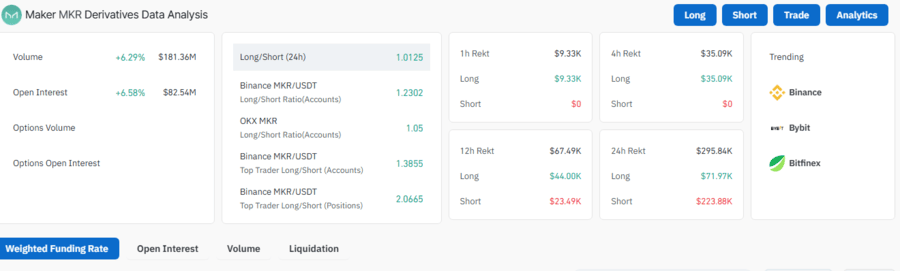

One other on-chain indicator that helped to find out Maker’s subsequent motion is Open Curiosity (IO). Metrics from Coinglass present that Maker’s IO rose by 6.58% from yesterday. This surge in IO means that derivatives merchants are shopping for premiums to keep up their positions. This alerts market confidence in MKR and signifies that merchants are keen about its future price actions.

Moreover, transaction quantity rose by 6.29% from yesterday, indicating a big outflow of MKR tokens from exchanges. This implies patrons are in management as buyers are more and more accumulating Maker and transferring tokens to their chilly wallets.

From a technical outlook, Maker is transferring inside an ascending channel sample (a bullish sample), suggesting an uptrend continuation. The decrease channel border assist is holding agency. An upswing potential towards the resistance ranges of $1,359 and $1,404 is predicted if the asset maintains bullish momentum. Nonetheless, a danger of fall towards assist ranges of $1,301 and $1,294 can also be anticipated if the asset loses energy.

![Simply launched: our 3 prime small-cap shares to think about shopping for in April [PREMIUM PICKS] – Tokenoy Simply launched: our 3 prime small-cap shares to think about shopping for in April [PREMIUM PICKS] – Tokenoy](https://www.fool.co.uk/wp-content/uploads/2024/05/Small-cap-1200x800.jpg)