The vibes are weird on the market. Meme cash could have lastly overstayed their welcome, however there’s nonetheless lingering fears that nihilism has contaminated the true believers. Now, this Bybit hack? Fret not. We’re nonetheless right here, writing and speaking about new monetary markets for a freer and extra sovereign world. Zhev continues this journey beneath, with a evaluate of the highest DEX gamers, and their plans to usurp TradFi. Onward.

– Chris

Whereas the prospect is unsavory for DeFi purists, there’s now little doubt that crypto’s biggest product – aside from stablecoins – is permissionless tokenization (and the buying and selling of such tokens). Greatest case, these tokens might be thought of analogous to firm shares, granting customers governance rights to pilot related merchandise in the direction of optimality. Because it currently stands, they’re merely a method to transform consideration into financial beneficial properties.

Over time, we have seen the evolution of assorted fashions of decentralized exchanges (DEXs) that search to facilitate the buying and selling of tokens. The distributed nature of blockchains reduces their potential to assist typical restrict order books, as is frequent in centralized exchanges. This is the reason the AMM mannequin is extra generally adopted for onchain buying and selling. As blockchains have scaled and buying and selling automated, we’ve seen a convergence between order books and AMMs to the purpose that they’re now (virtually) indistinguishable.

A lot has been discovered for the reason that days of 0x and Bancor. The hypothesis and frenzy of DeFi, NFTs, and memecoins has spurred newer and higher alternate designs which can be near an optimum state of usability. On the core, these designs are all targeted on minimizing and democratizing MEV.

Under, we zone-in on the onchain market-models improvement pattern by analyzing prime gamers in derivatives and spot buying and selling. Particularly: Drift, Jupiter, dYdX, Hyperliquid, and Uniswap.

Based mostly on our evaluation, it appears we’re near the top state for market design. And that the winner of this spherical in DeFi would be the one who knocks off TradFi.

Earlier than we get into the evaluate and evaluation, a fast recap on normal properties and concerns when constructing exchanges as they relate to underlying blockchains.

The preliminary mannequin for blockchains was a single information layer, which all kinds of actions might be coordinated and recorded on, evident in Bitcoin, Ethereum, and Solana’s design. We check with this mannequin as ‘general purpose chains’, i.e., chains that are not constructed to cater to any particular software class, however quite to assist as many as attainable.

Typically, this mannequin faces a trilemma of tradeoffs between safety, decentralization, and throughput: optimizing for any two of those objectives lessens the chain’s probabilities of reaching the third. It’s a subjective perception for spectrum-based metrics – however a broadly acknowledged one – that Ethereum has prioritized safety and decentralization at the price of throughput. That is much like Bitcoin, which is even much less decentralized lately, however in distinction to Solana, which pursues safety and throughput with much less concentrate on decentralization.

So whereas purposes can launch on Ethereum to entry higher safety and censorship-resistance ensures, Solana is arguably a greater chain for latency-sensitive purposes comparable to restrict order ebook markets.

Nonetheless, it’s not information that normal function chains are inherently restricted within the quantity of throughput they will supply purposes constructing atop them. Much more so in the event that they want to keep a reputable degree of decentralization/distribution. Moreover, most purposes could want to retain their worth quite than leaking it to the underlying chain by MEV. These are the driving concepts of the appchain strategy.

All application-specific chains (or just, appchains) must make design decisions regarding their consensus community/mechanism, most well-liked digital machine, whether or not to be an L1 or L2, and different optimizations. L1 appchains get pleasure from ground-up constructing that permits them to make enhancements by customizing parts, whereas L2 appchains are simply composable with their L1s – and doubtlessly different L2s – making it simpler to draw liquidity.

All these components have to be thought of, particularly for onchain exchanges, because the slightest misconfiguration in setup may result in an incorrect liquidation, a foul order match, or another myriad of faults that will scare away person liquidity. Maybe unsurprisingly, most groups desire the L1 appchain setup for personalisation advantages and take care of liquidity attraction as a secondary concern, quite than threat reliance on an exterior avenue.

The desk beneath summarises the important thing traits throughout the three foremost approaches to selecting a series for an software.

It’s now time to go over the structure of the 5 aforementioned dominant DEXs. Given the concerns every can have needed to make round design (as highlighted above) we current these DEXs categorised beneath every of the three foremost approaches.

Drift

The Drift protocol is constructed atop Solana, permitting it to comfortably serve limit-order-book-based exchanges inside sure bounds. It’s an onchain decentralized alternate that settles person trades by way of three routes:

-

Simply-in-time (JIT) liquidity auctions: Orders are submitted to a committee of market makers who compete to fulfill the order at the absolute best price inside a specified window.

-

Restrict order ebook: Customers specify their most well-liked order settlement costs throughout submission to a community of ‘keeper bots’. These bots every keep an offchain index of submitted orders, which they will both:

-

type and match by price-time precedence to different restrict orders

-

use to fill a JIT liquidity public sale, or

-

settle by way of the digital AMM’s reserves.

-

-

Digital automated market maker (vAMM): A final-resort liquidity supply for the assured settlement of person trades.

Jupiter

Whereas Jupiter is generally used as an aggregator, it has additionally developed a derivatives market, providing customers up to 100x leverage on a restricted variety of property. Jupiter’s aggregator product permits it to have higher stream and deeper liquidity reserves, which in the end indicate higher order settlement costs for customers.

The derivatives alternate is supported by the Jupiter Liquidity Supplier pool (JLP) which acts equally to an AMM pool to simply accept person property as a liquidity backstop for orders, nonetheless the customers’ orders are for derivatives, quite than spot positions.

Processing of orders happens in a two-step course of:

-

The person submits a “request” transaction of their order to the chain by way of the appliance’s entrance finish.

-

A keeper displays the request transaction onchain and executes it utilizing liquidity from the JLP pool.

The performant L1 strategy for DEXs rests on the situation that the income of privileged brokers (e.g. block builders, validators, proposers and so on.) within the default mechanism is bigger than the income they’d get from malicious actions comparable to sandwiching. Varied L1s have adopted extraneous guardrails for these issues: Flashbots for Ethereum, Jito for Solana, and Skip for Cosmos. Nonetheless, speedy order processing with ample censorship-resistance remains to be not in sight.

Within the case of Drift/Jupiter and Solana, the underlying L1’s said purpose is to function a decentralized NASDAQ, or extra lately to “increase bandwidth, reduce latency”. This implies pursuing throughput and safety on the expense of decentralization. As Solana’s throughput will increase, the {hardware} necessities for validators do as effectively, causing more validators to fall behind or shut down operations solely.

This leaves the community within the fingers of only some validators who will inevitably start exploring different avenues for income apart from the inspiration’s subsidy. This additionally means purposes atop (comparable to Drift) will start to leak worth to such ‘unaligned’ validators, leaving customers worse off as a consequence of MEV.

Nonetheless, the seek for the proper L1/L2 continues with the likes of Motion, MegaETH, Monad, and Atlas scheduled to enter the body very quickly.

dYdX v4

dYdX was one of many first suppliers of onchain derivatives. The dYdX Group has since pivoted from an Ethereum Layer 2 chain providing, to constructing a standalone L1 throughout the Cosmos hub. V4 was launched as a CosmosBFT-based L1, to allow the protocol to reap the benefits of the mechanism’s comparatively unopinionated design specs and customise validators’ duties to extend throughput.

The dYdX chain is populated by validator nodes (that are chargeable for gossiping/executing orders and finalizing blocks) and full nodes (which go real-time information to indexers). Subsequently, the chain’s p2p community is chargeable for:

-

Executing obtained orders by matching them to one another.

-

Together with matched orders in blocks and increasing the chain.

-

Offering the information associated to order execution to customers.

Half c. is carried out collaboratively with indexers, that are read-only information endpoints optimized to serve customers equally to RPCs in Ethereum. Indexers ingest information streams from full nodes and decompose them into both onchain or offchain classes, earlier than serving them to customers or anybody else.

Having a p2p community with customizable features permits the dYdX chain to implement a novel MEV mitigation scheme by ‘vote extensions’. Its technique is two-fold because it:

-

Eliminates the block proposer’s first-look privilege by enabling collaborative block constructing with different validator nodes, successfully simulating a leaderless mechanism (though execution remains to be solely the proposer’s responsibility).

-

Implements a frequent batch public sale (FBA) in every block for equally priced orders, in order that ordering benefits are minimized.

Hyperliquid

One other instance of the appchain strategy, Hyperliquid has gained spectacular traction inside barely two years of launch. This was initially as a consequence of its easy UX relative to opponents, with customers hailing it as an onchain, no-KYC centralized alternate. Then got here its HYPE token, which has turn into the brand new customary for honest product token launches.

The Hyperliquid L1 is a PoS chain that runs on a variant of the HotStuff consensus mechanism known as HyperBFT. This mechanism is optimized to allow validators to run a low latency order ebook that serves customers at a self-reported common charge of 100k orders per second.

Up to now, it appears the L1 appchain strategy hasn’t lived up to the related hype because of the distinctive points each dYdX and Hyperliquid face. On one hand, dYdX remained steadfast to the open-source/decentralized ethos of crypto to construct an L1 that’s sufficiently censorship-resistance for its functions. Nonetheless, it has been criticized for its weaker efficiency that has brought on it to lose a fantastic portion of market share. Its token distribution mannequin can be being known as beneath query because the underlying reason for its continued underperformance, particularly because it may simply be seen as extractive and unfriendly to retail buyers (relative to Hyperliquid’s pleasant airdrop and distribution mannequin).

On the opposite aspect, Hyperliquid has gone its personal route with largely closed-source developments and a centralized mannequin. Critics say its fast rise to success is because of quite a lot of centralization that persists at virtually each degree of the appliance. Its proponents are inclined to disagree, particularly given its continued outperformance on virtually each metric. Nonetheless, these two arguments do not overlap; if something, Hyperliquid’s continued success factors to the chance profile of its customers. We consider it’s product, simply not a DeFi product. But.

Whereas we current Unichain for example beneath the L2 appchain strategy, it’s price noting that the creating workforce (Uniswap) is probably higher labeled as a ‘composable stack’. It’s because their merchandise span nearly each space, from wallets to numerous DEX fashions, and now a DeFi appchain.

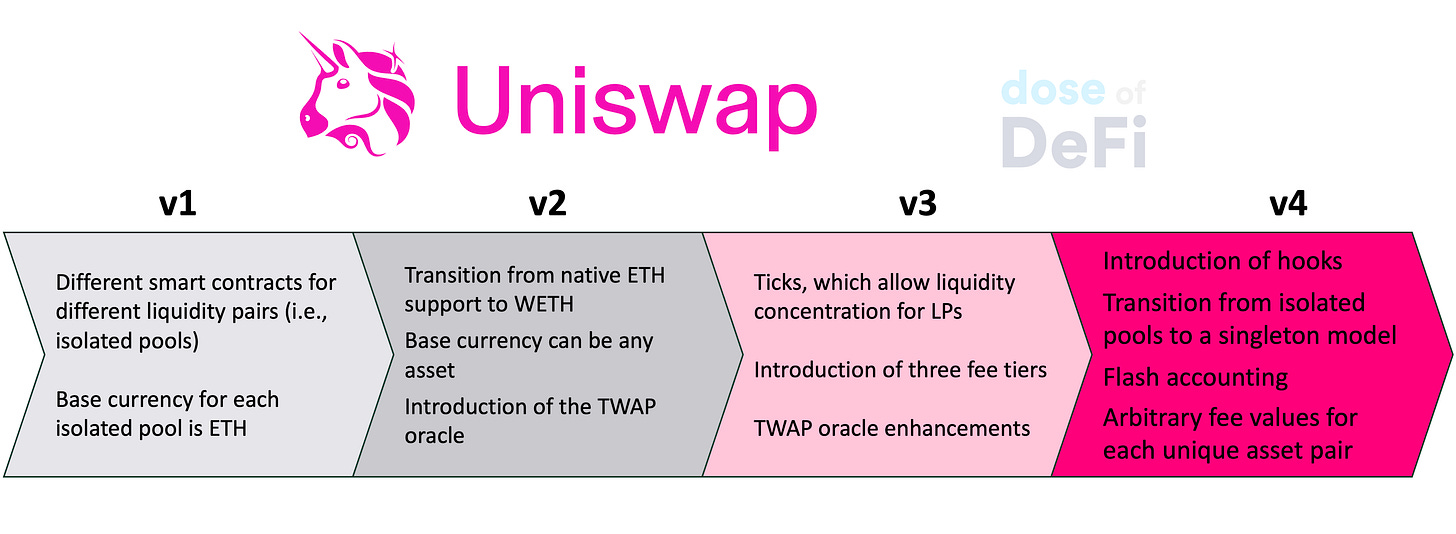

Uniswap began its journey as a permissionless AMM with asset costs outlined by their portions in a pool. Over time, the preliminary mannequin has been altered to satisfy the calls for of an ever-evolving person base, as summarized within the desk beneath:

The newest iteration comes with quite a lot of enhancements, essentially the most notable being hooks and the singleton structure:

-

Hooks are subsidiary contracts that may be known as at a particular level throughout a person’s interplay with a liquidity pool, so as to set off a pre-designated motion.

-

The singleton structure is an optimization for saving gasoline, however it additionally permits what’s known as ‘flash accounting’. This technique permits Uniswap v4 to switch property solely on web balances, in order that swaps involving a number of liquidity swimming pools would require much less onchain storage updates and consequently be extra environment friendly.

Collectively these options shift Uniswap v4 in the direction of the modular design precept for lending markets we discussed previously. As such, it’s now not a easy product however a platform, to which complexity might be safely launched by builders with out lack of composability.

Except for its main product, the Uniswap workforce has additionally created an RFQ market, UniswapX. That is primarily an intent-powered market whereby customers can outline their most well-liked execution situations for a commerce, whereas fillers compete in an public sale to fulfill person preferences.

Whereas seemingly totally different, each Uniswap v4 and UniswapX are literally complementary, as has been laid out by the team. The introduction of hooks and arbitrary charge values in Uniswap v4 results in better liquidity fragmentation throughout distinctive swimming pools, resulting in increased routing complexity that interprets to increased transaction charges for the person. Whereas the Uniswap auto-router is optimized to unravel this drawback, there isn’t any assure that its chosen route for a person’s transaction is essentially the most optimum; thus customers pay extra with no assured outcomes.

This drawback is being addressed by UniswapX, which permits customers to set tight bounds on their expectations whereas offsetting execution to skilled fillers, who’ve entry to extra data and stock, and compete to fulfill customers for a charge. Cowswap is coming at this from the opposite path, beginning first with an intents-based aggregator after which designing a MEV-capturing AMM.

The Uniswap workforce has additionally introduced they’re constructing out a new rollup tailored for DeFi applications called Unichain. Whereas this got here as a shock to some, it is sensible that one of many largest drivers of order stream would want to control it better, particularly since higher stream management implies higher MEV mitigation (amongst different issues).

Moreso, the reworking of Uniswap v4 as a baseplate will inevitably drive the necessity for a extra performant base layer, one which may simply assist hooks’ options, particularly the required throughput. For instance, within the case of the pace mandatory for onchain restrict orders. Uniswap v3 already had the best type of restrict order books with its ticks, so v4’s hooks will inevitably good this, after which require extra infrastructure assist.

Unichain can simply fulfill hooks’ latency calls for with its ‘flashblocks’ (primarily glorified pre-confirmations), whereas decreasing the poisonous stream customers are uncovered to as a consequence of ordering by way of its sequencer-builder separation mannequin.

Whereas these DEX initiatives are all competing with one another, they’re actually after CEXs and King Binance, the place most by-product and spot buying and selling takes place. It’s telling that there hasn’t been a brand new profitable upstart CEX this cycle. There’s no FTX attempting to problem Binance. Actually, it’s Hyperliquid that has lastly eaten into Binance’s overwhelming lead. And the latter certainly feels threatened, making (in)direct shots at Hyperliquid on X.

Hyperliquid feels very a lot of the second. It’s rightly criticized for its extraordinarily centralized mannequin, but when we take a step again, we are able to see that it represents an evolution of recent exchanges launching with increasingly more crypto-native monetary infrastructure first. Coinbase was a CEX, however then Binance launched with a token from the beginning. Now Coinbase has its personal L2 and whereas Binance.com is dominant, BSC is arguably one of the big three smart contract blockchains, together with Solana and Ethereum.

Actually, all new innovation in crypto exchanges lately is coming from DEXs and in DeFi. CEXs gave us the perpetual by-product – a genuine financial innovation – however DEXs are faster to record tokens, unlock new yield alternatives, new pooled lending, and most significantly, are driving the RWA push. Coinbase and Binance usually are not attempting to innovate TradFi with their CEXes. They’ve guess on Base and BSC to try this.

The important thing query is whether or not the DEX that slays TradFi can be one that makes a speciality of sturdy distribution and on & offramps, like Binance, Coinbase or Hyperliquid, or from one the place the tech shines first (be it an L1/2 app chain or high-performant normal function chain). Our guess is on the infrastructure wagging the distribution, finally.

-

North Korea hacks Bybit for $1.5bn Link

-

Coinbase says SEC has agreed to drop enforcement case Link

-

Hummingbot releases v2.3 Link

-

Vitalik proposes increased gasoline limits for Ethereum L1 Link

-

Berachain: A narrative instructed by charts Link

-

Ethereum Basis deploys 45,000 ETH into DeFi Link

-

Overview of recent regulatory efforts in US congress Link