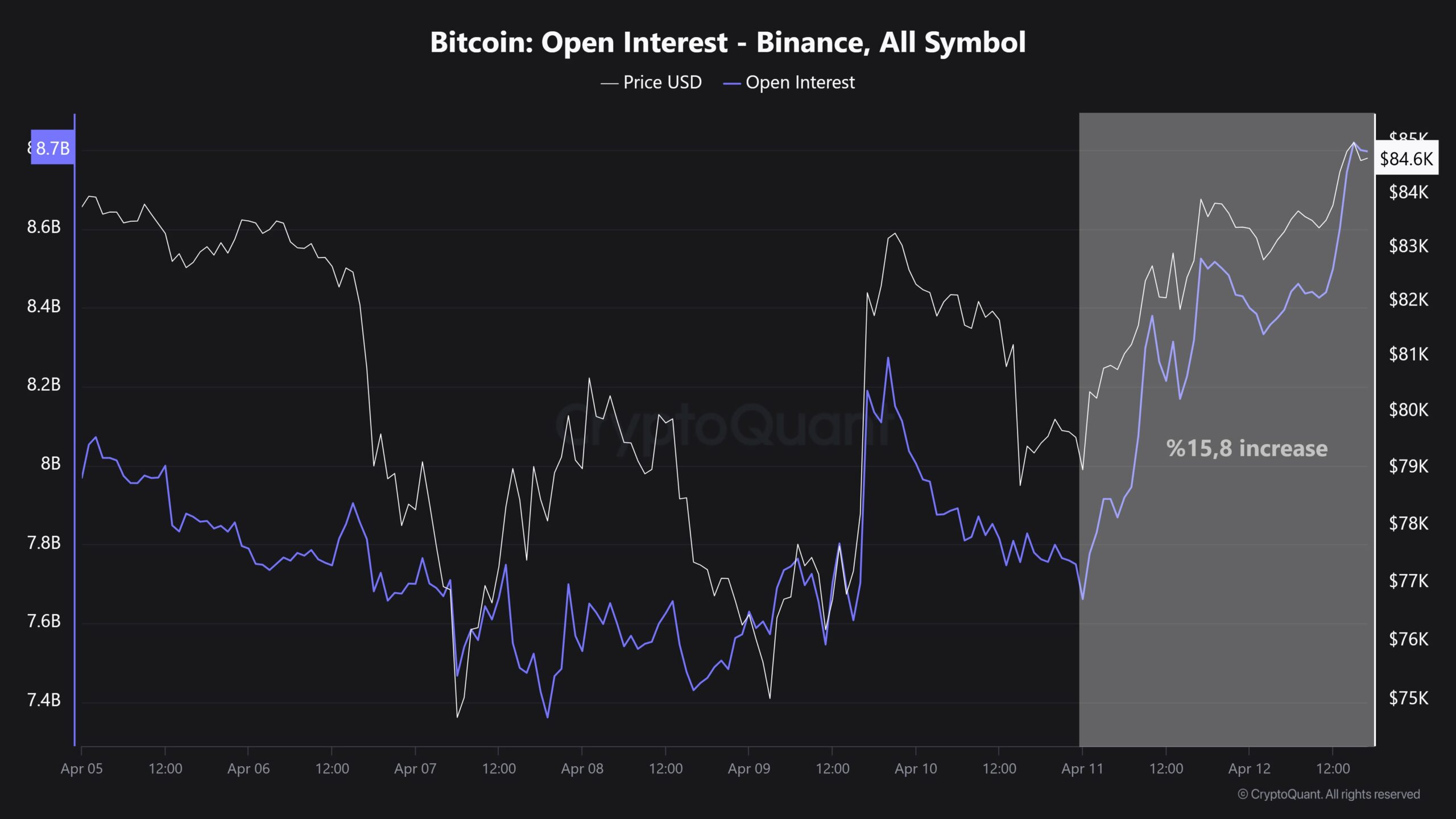

- Bitcoin’s OI made a exceptional 15.8% soar because the weekly CME futures closed at $84K.

- BTC sliced via the 50-day SMA, with the subsequent key hurdle being the 200-day SMA at $87K.

Binance’s Bitcoin [BTC] Open Curiosity (OI) noticed a 15.8% development in a day, elevating it from $7.6 billion to $8.8 billion, at press time. The market and dealer engagement elevated considerably due to this fast $1.2 billion enhance.

Binance remained dominant in crypto derivatives buying and selling, as its OI place occupies 31.4% of the $28 billion complete OI capital.

Quick-rising OI signaled the danger of market volatility, as these wide-ranging liquidations might affect each prolonged lengthy and brief positions with excessive leverage.

A rise in OI typically signifies rising bullish sentiment; nonetheless, it might additionally set off opposing market actions or immediate aggressive place unwinding.

A pointy rise in OI might end in transient price fluctuations, primarily pushed by shifts in market sentiment or failed makes an attempt to keep up crucial resistance ranges.

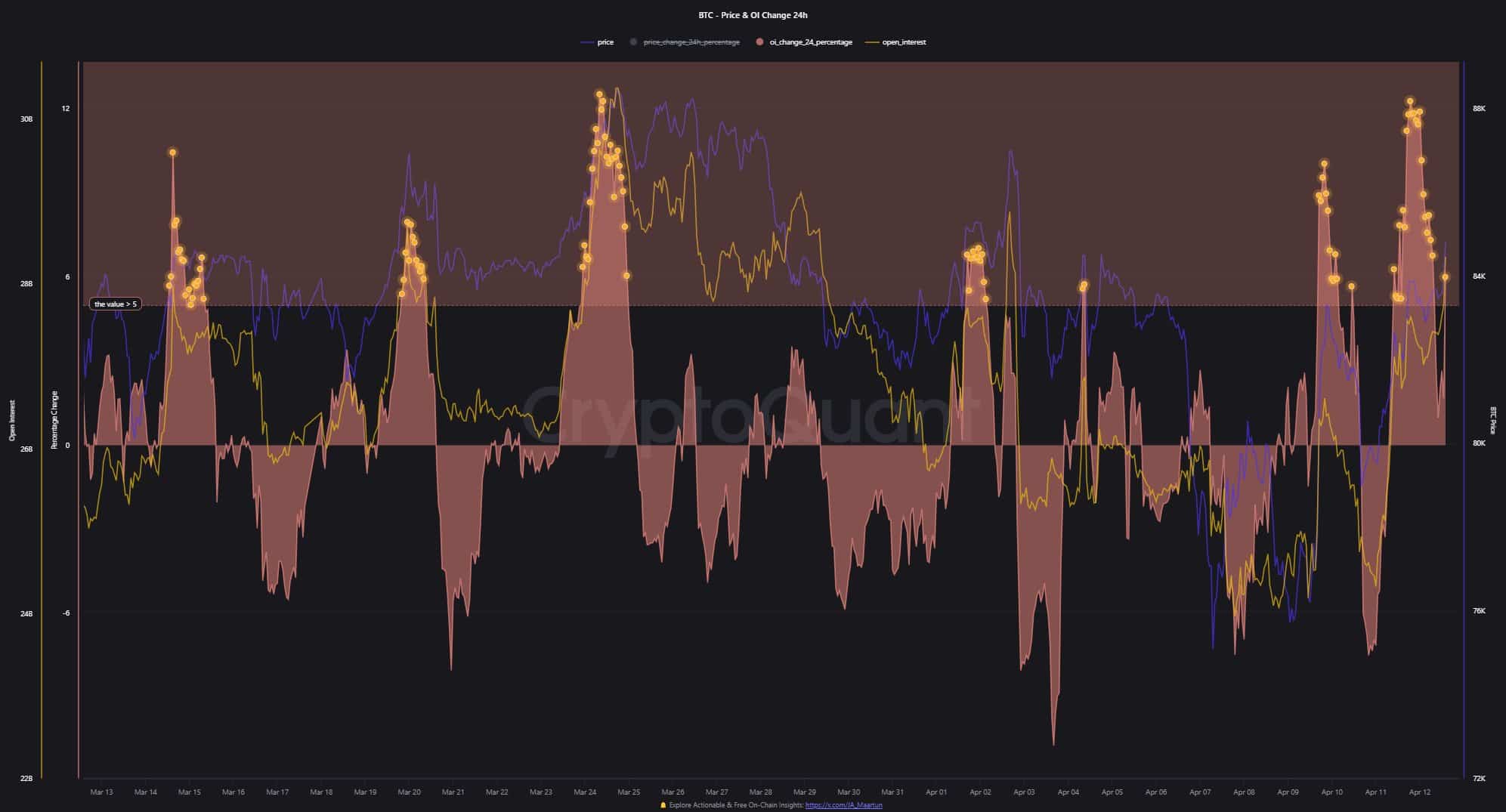

Leverage pushed pump and exercise

Following this, BTC spot costs closed on the $84K stage, as recorded within the weekly CME futures. The pump was as a consequence of will increase in extreme leverage, though this motion triggered dangers for short-term market merchants.

This robust uptrend within the 24-hour proportion modifications in OI confirmed a number of factors exceeding +5, indicating excessive lengthy sentiment.

The latest price surge, pushed by high-leverage positions, highlighted dangers of fast compelled gross sales, just like developments noticed up to now. This stage of market leverage underscored the significance of warning for merchants.

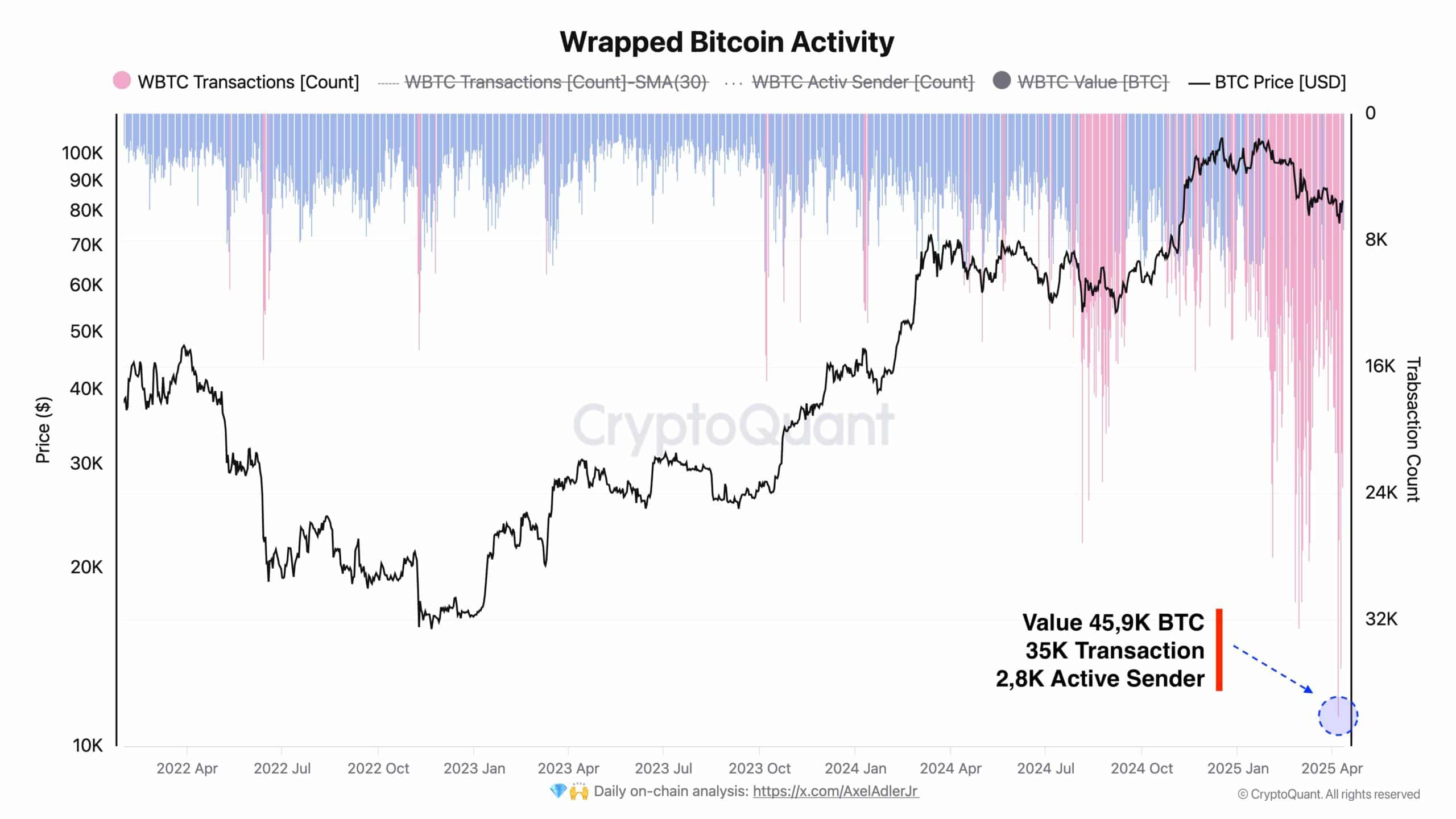

On the similar time, Wrapped BTC [WBTC] exercise reached an all-time excessive, with 35,000 transactions executed throughout 2,800 energetic wallets, and a complete motion of 45.9K BTC.

These developments occurred amidst heightened market volatility brought on by geopolitical crises and commerce conflicts between nations. Regardless of these macroeconomic pressures, WBTC customers confirmed resilience, persevering with to drive a notable enhance in transactions.

Regardless of the 2 oppositional evaluations the place leveraged positions appeared to trigger short-term price fluctuations, WBTC exercise signaled enduring performance within the BTC area.

BTC potential price strikes

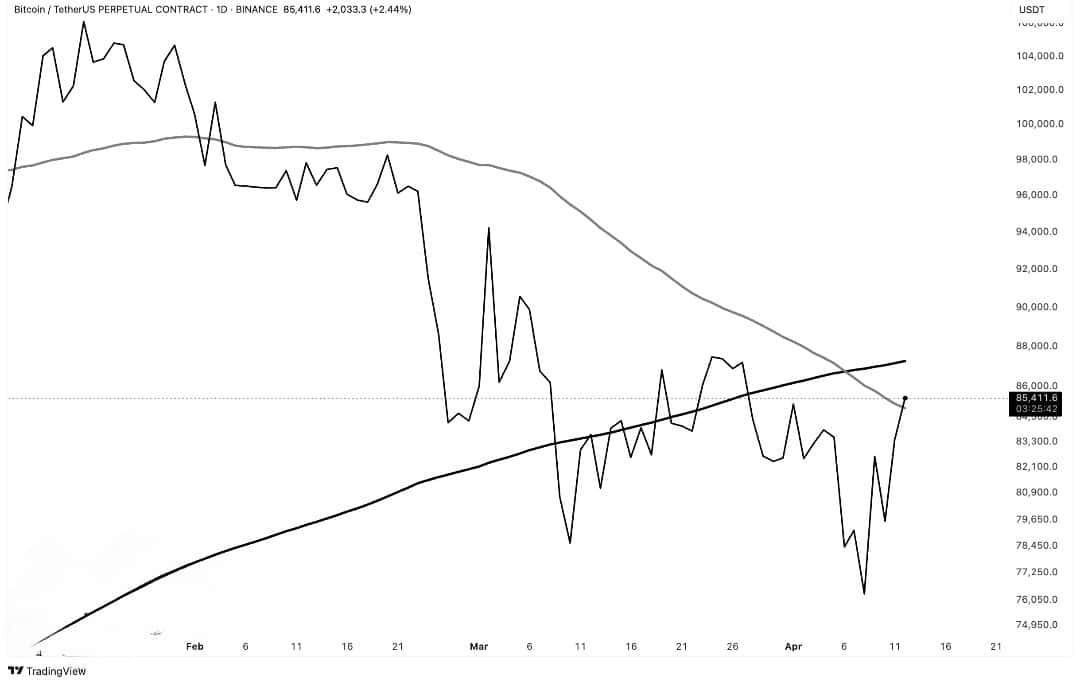

BTC additionally sliced the 50-day Easy Shifting Common (SMA) because it approached the resistance on the 200-day SMA.

This breakout confirmed an growing bullish development and a transfer above $87K might seemingly validate ongoing development towards $94K, whereas vendor intervention is feasible close to that stage.

If the price stays beneath $87K, it might verify the warnings related to latest leverage-based pump actions.

This might imply reaching as little as $79K or $76K if costs drop beneath $84K, which might counsel additional bearish momentum.

The market’s indecision was confirmed by its stationary motion, which stayed between two basic shifting averages.

Traders wanted to look at robust price actions on both aspect to get BTC’s future route.

Market sentiment might flip bullish if costs exceed $87,000, however steady bearish efficiency beneath that stage will most likely maintain a consolidation part or prolong the present correction interval.