- BTC traders stay optimistic regardless of current market volatility.

- Bitcoin’s common Funding Charge throughout 4 main exchanges has declined into unfavourable territory.

Over the previous day, Bitcoin [BTC] has skilled excessive volatility. By way of this era, the costs have fluctuated from a low of $81k to a excessive of $85k, then retracing to $84k at press time.

Regardless of the present market volatility, key stakeholders stay optimistic and anticipate market stability.

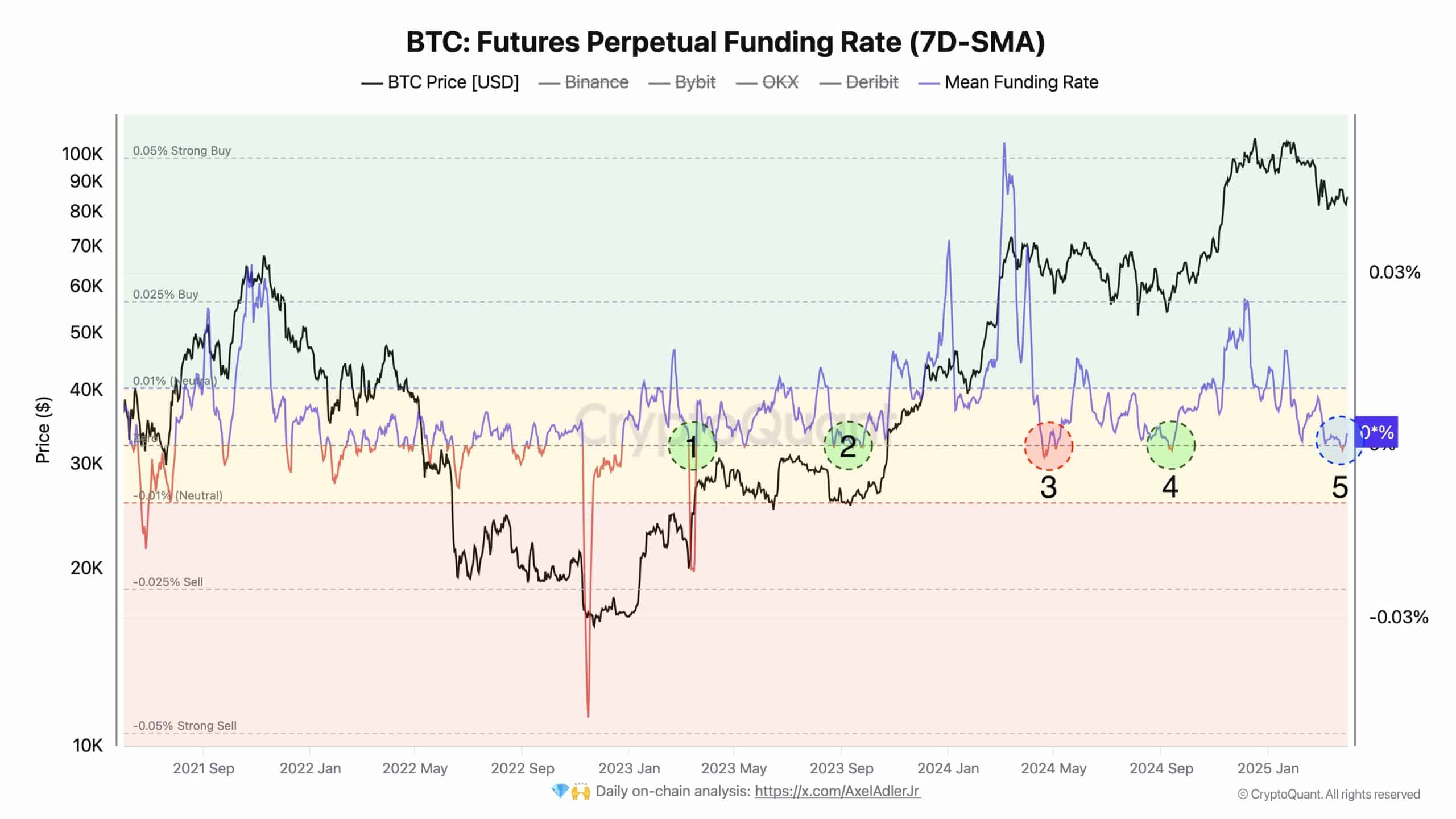

Inasmuch, CryptoQuant analyst Axel Adler has predicted an upcoming market stability, citing Bitcoin’s common Funding Charge.

Bitcoin’s Funding Charge hits unfavourable

In his evaluation, Adler noticed that on the 4 main exchanges; Binance, Bybit, OKX, and Deribit the typical Funding Charge has declined into unfavourable territory.

Throughout this cycle, the market has witnessed 4 related situations the place the typical Funding Charge dropped to unfavourable. Throughout these situations, BTC costs rebounded, whereas solely as soon as that costs declined.

This means {that a} drop to unfavourable territory is prone to lead to price enhance than decline.

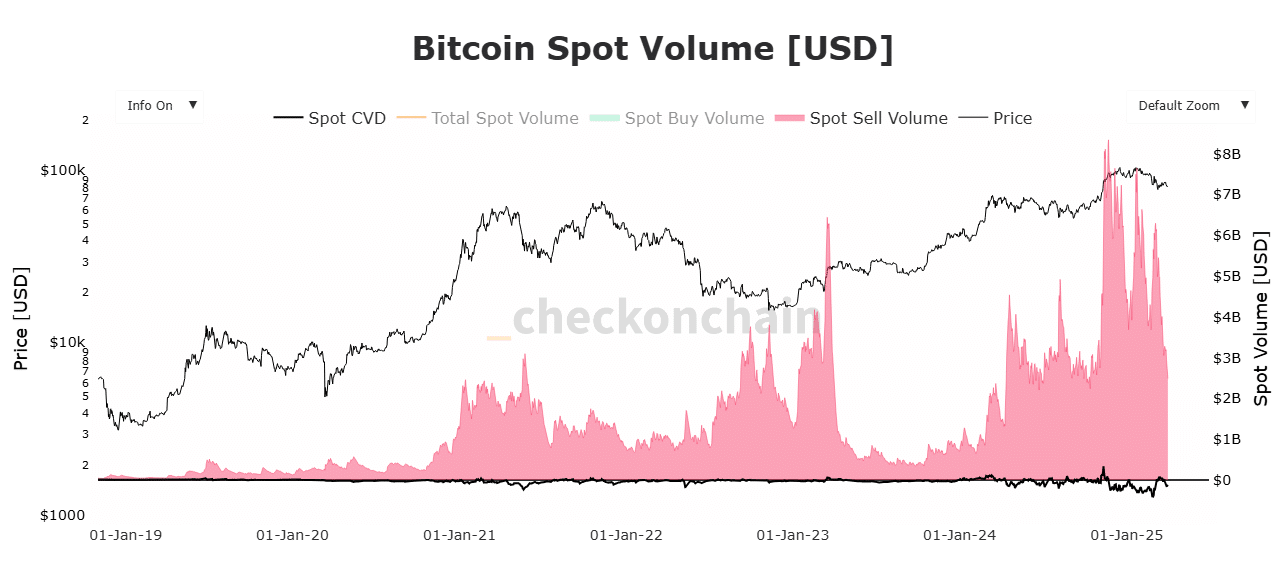

To make his case, the analyst famous that, at the moment, the company sector is actively shopping for Bitcoin, whereas the spot market promoting strain is minimal as skilled traders have stopped promoting.

The lowered promoting is evidenced by the declining spot promote quantity which has dropped from $6.2 billion on the fifth of March to $2.4 billion as of the first of April.

This implies promoting quantity has lowered by $3.8 billion in lower than a month.

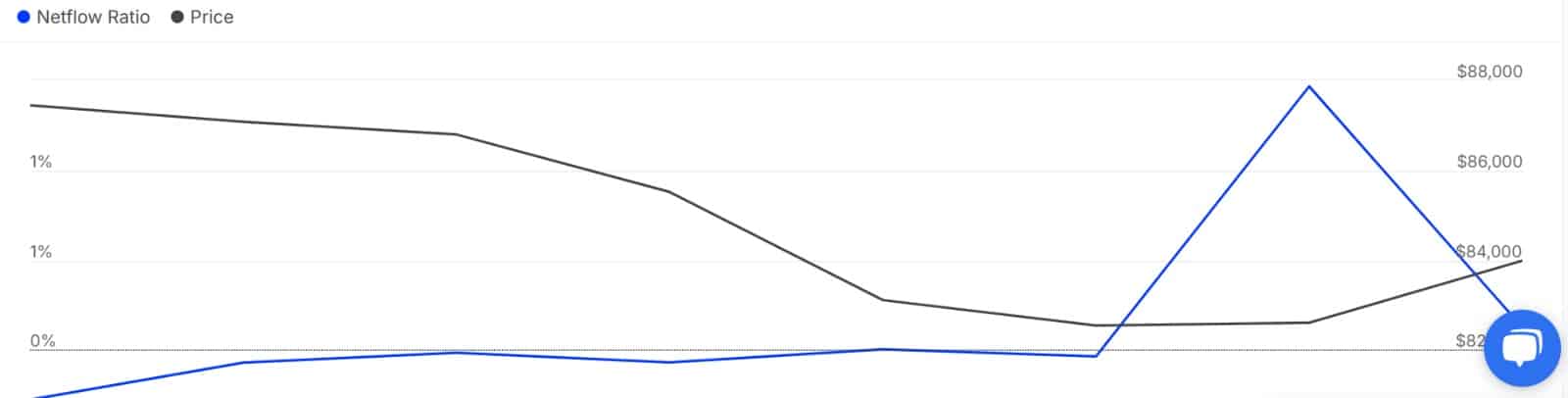

Additionally, whales aren’t promoting as a lot. Actually, whale-to-exchange exercise has seen a pointy decline.

Thus, whale-to-exchange stream has dropped from 1.76% to 0.15% suggesting that whales have lowered the quantity of Bitcoin they’re sending into exchanges to promote.

This market habits means that though markets are seeing promoting actions, it’s progressively declining.

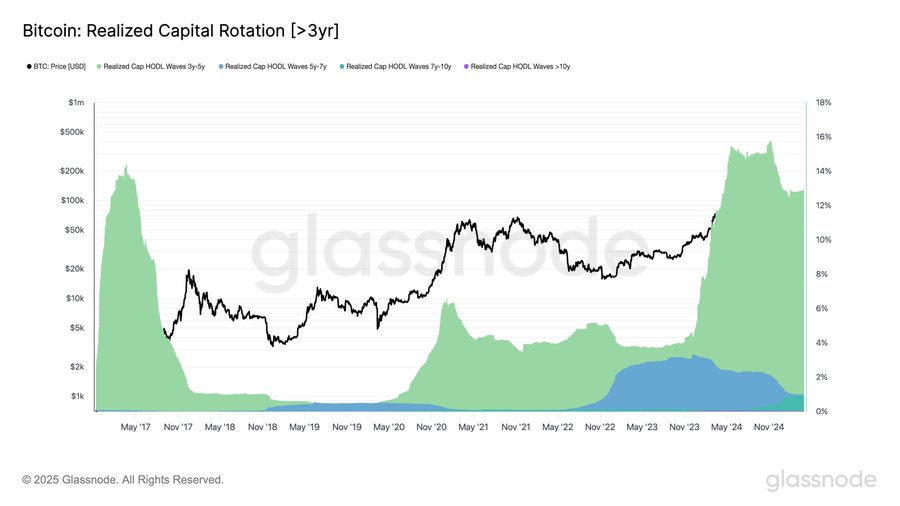

One other facet signaling market restoration is the truth that long-term holders have returned to the marketplace for accumulation.

Though the share of wealth held by traders who purchased $BTC 3–5 years in the past has declined by 3% since its November 2024 peak, it stays at traditionally elevated ranges.

This means that almost all of traders who entered the market between 2020 and 2022 are nonetheless holding.

These three facets point out a normalization of market circumstances after the overheating section. Nevertheless, the market remains to be dealing with one main situation that’s now standing towards a possible price rebound.

The one challenge is poor macroeconomic indicators which are blocking BTC’s progress.

Due to this fact, optimistic alerts from the Fed and the Trump Administration might renew the influx of money through ETFs, probably triggering the beginning of a brand new rally.

What’s subsequent for BTC?

As noticed above, Bitcoin traders are within the perception section and count on as soon as macroeconomic points stabilize, BTC costs to rebound.

As such, with retailers, whales, and long-term holders turning bullish, Bitcoin might see a robust rebound on its price charts as soon as exterior components turns favorable.

Due to this fact, if historical past repeats itself accompanied by bullish sentiments at the moment noticed out there, BTC costs will enhance.

An upside transfer from present price will see BTC reclaim $86701 resistance which is able to set the crypto for a breakout above $87k.

Conversely, if the anomaly of 1 occasion noticed throughout this cycle reoccurs, a retrace will see a drop to $81155.