- Bitcoin slipped beneath $84k after a sizzling U.S inflation print

- New Trump tariffs might decide the following route for the cryptocurrency

Bitcoin [BTC] briefly retraced beneath $84k following a warmer PCE inflation print throughout early Friday’s U.S buying and selling session. BTC’s decline adopted Nasdaq’s 2% drop. Nonetheless, gold jumped to a brand new excessive, reiterating traders’ risk-off mode and macro uncertainty, particularly forward of President Trump’s new tariffs.

In response to Coinbase analysts, the crypto’s price might stay range-bound ($78k-$88k) till then. They stated,

“We anticipate range-bound trading at least until April 2nd, the deadline for President Trump’s tariffs.”

The analysts additional warned that April-June have been “tough months” for crypto on a seasonal foundation. They steered lowered publicity as an amazing technique.

Bitcoin – STH misery?

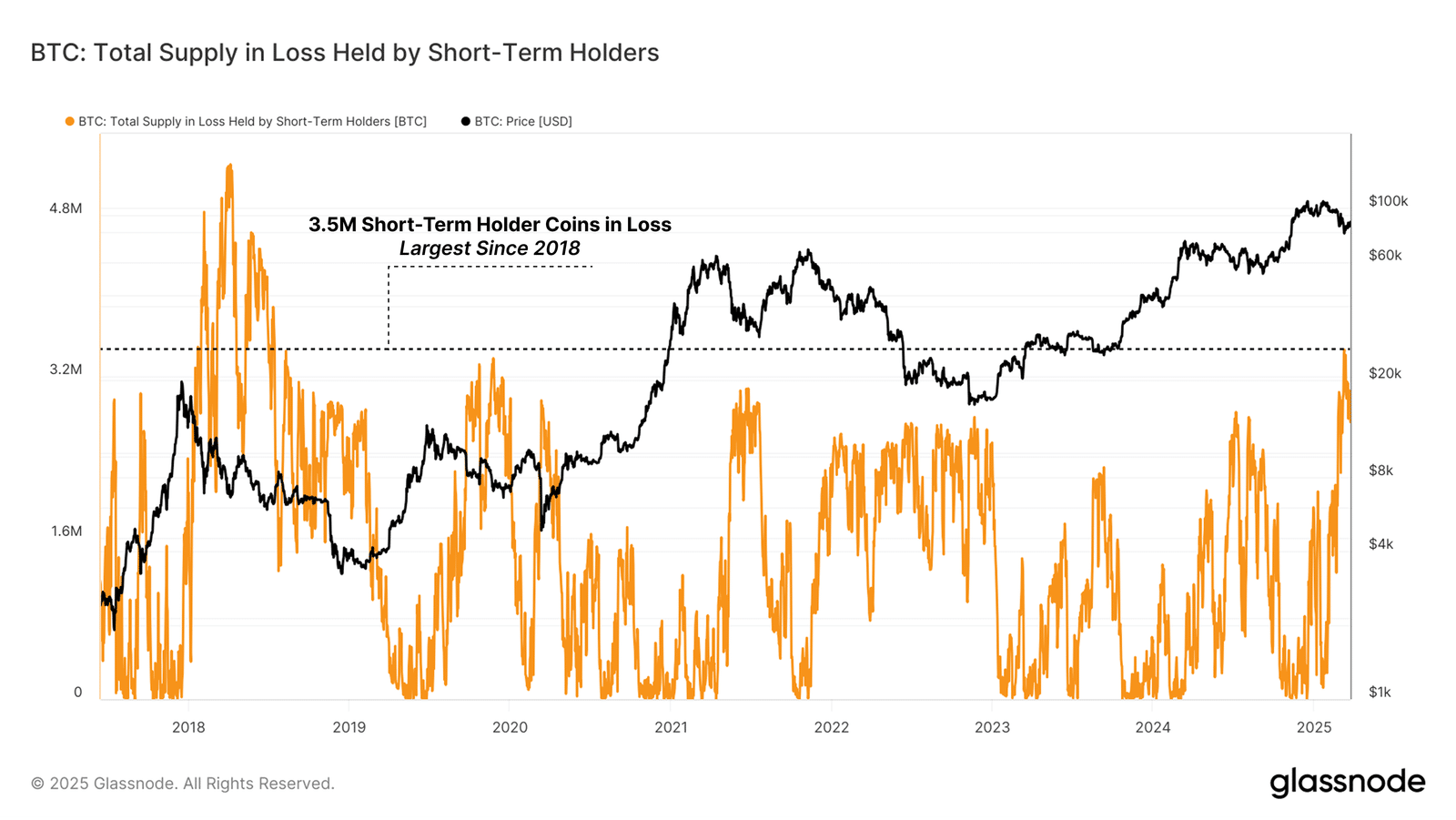

The cautious outlook was additionally evident on-chain, as per the monetary misery confronted by short-term holders (STH). These are new traders (prime patrons) who’ve held BTC for lower than six months and sure purchased the asset above $90k or $100k.

In response to Glassnode, the availability held by STHs hit a 7-year excessive lack of 3.4 million BTC.

“Recent downside volatility has created strenuous conditions for new investors, with the volume of Short-Term Holder supply held in loss surging to a massive 3.4M BTC. This is the largest volume of STH supply in loss since July 2018.”

The analytics agency added that the prevailing strain might heighten the “probability of a market-wide capitulation event.”

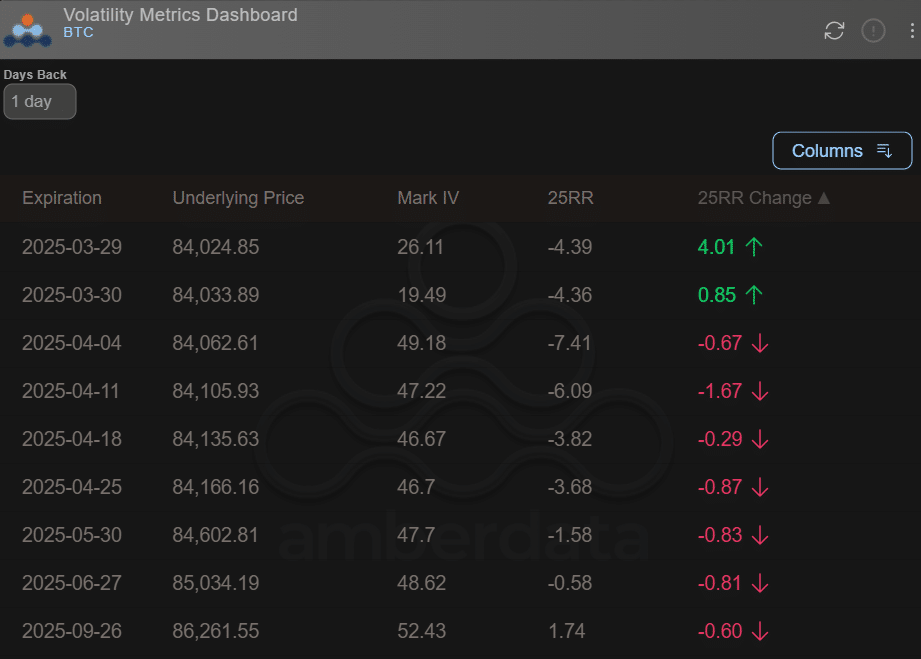

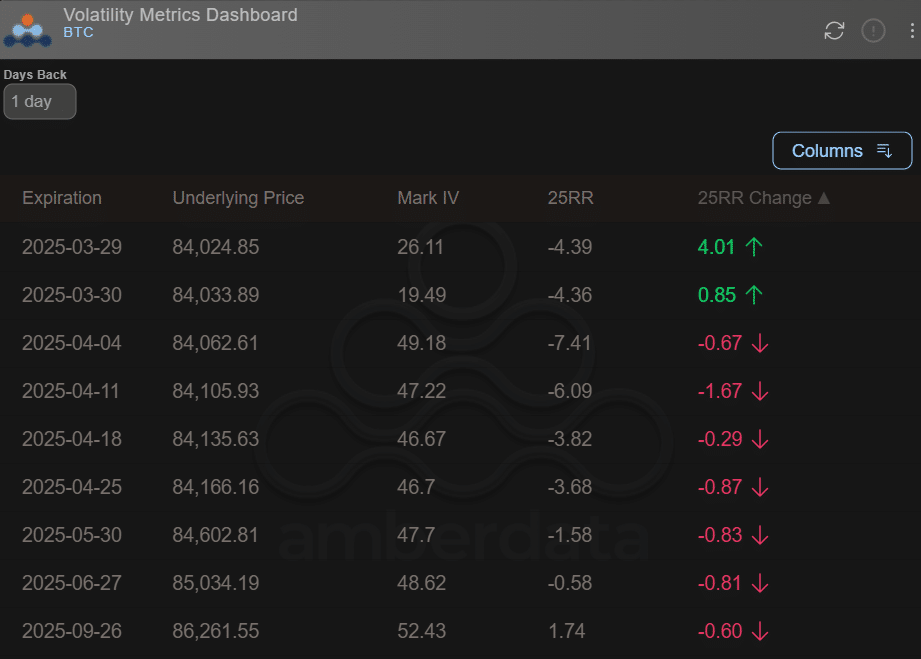

Even Choices merchants appeared to be positioned for additional draw back threat situations within the brief time period. In response to Amderdata’s 25-delta threat reversal (25RR) indicator, as an example, Choices expiries for 04 April (-7.41) and 11 April (-6.0) had been destructive, on the time of writing.

Supply: Amberdata

This hinted at an uptick in hedging exercise and extra demand for put choices (bearish bets) for the following two weeks. Merely put, speculators expect potential dips in early April.

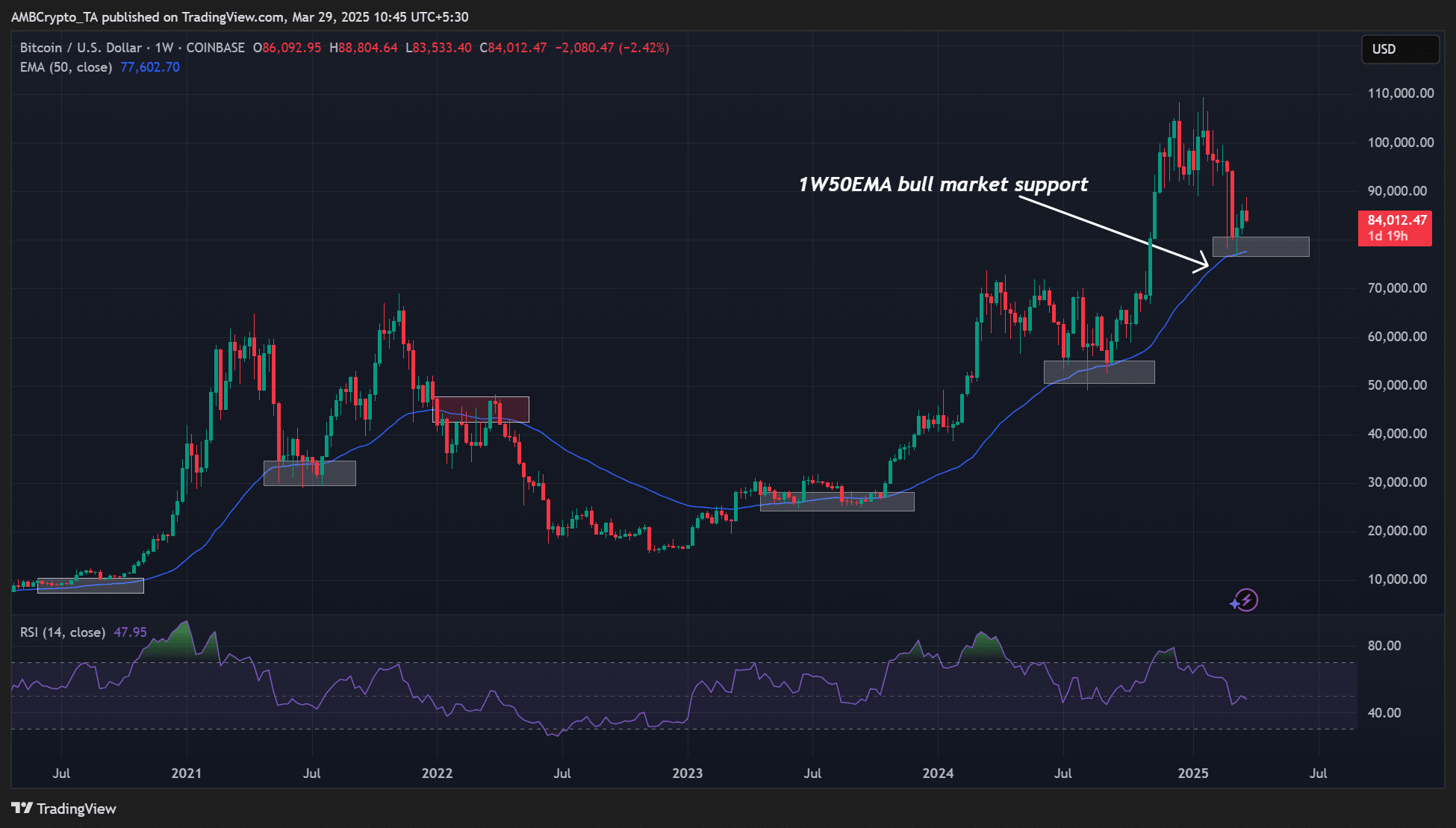

Value noting, nonetheless, that it might not be all gloomy. When zoomed out on the weekly price charts, BTC defended the weekly 50-EMA (exponential shifting common, 1W50EMA). This dynamic stage was a key assist up to now bull runs of 2021 and can also be one within the present 2023-2025 cycle.

Merely put, Bitcoin’s general market construction remains to be bullish. Nonetheless, if a sustained break beneath 1W50EMA happens, the asset could possibly be deemed to be in a bearish development – A warning shot to bulls.

So, it’s a key stage to observe in Q2.

![Simply launched: March’s small-cap inventory suggestion [PREMIUM PICKS] – Tokenoy Simply launched: March’s small-cap inventory suggestion [PREMIUM PICKS] – Tokenoy](https://www.fool.co.uk/wp-content/uploads/2024/05/Small-cap-1200x800.jpg)