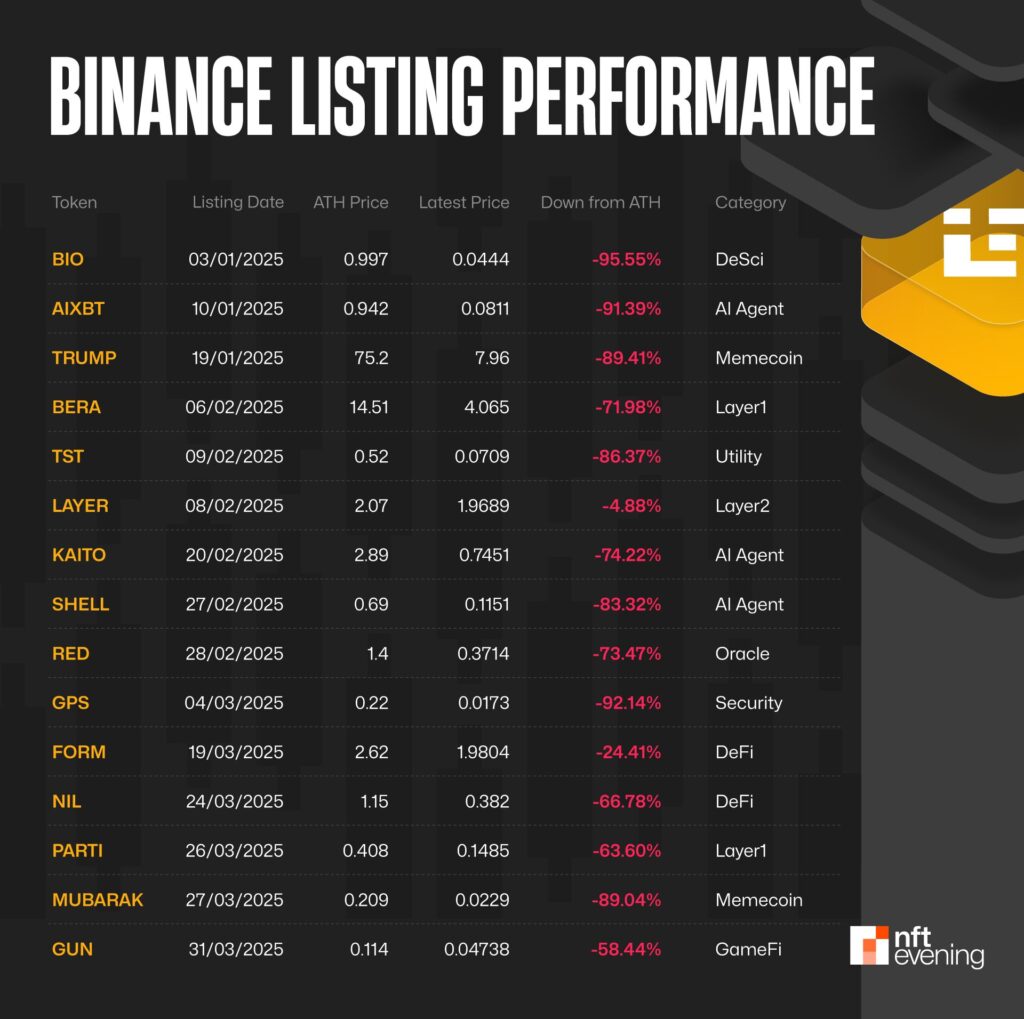

Just lately, the persistently poor efficiency of tokens listed on Binance triggered widespread disappointment within the crypto market. With solely 2 out of 27 tokens listed in Q1 2025 exhibiting price features, the remaining 89% have plummeted, some dropping up to 90% of their worth.

This stark underperformance has sparked widespread skepticism amongst traders, eroding belief in Binance as a platform for high quality initiatives. As an alternative, many now view Binance listings as a predictable cycle of hype, pump, and dump. This text explores the extent of this concern, highlights particular circumstances, and suggests causes behind the declining confidence in Binance’s itemizing technique.

Binance Listings: From Hype to Heartbreak!

The info paints a grim image. In Q1 2025, Binance listed 27 tokens, however solely $LAYER (+86.73%) and $FORM recorded features. The remainder, together with high-profile tokens like $TRUMP, $MUBARAK, and $PARTI, suffered important losses.

As an example, $TRUMP, hyped as a meme coin tied to political narratives, crashed by over 70% shortly after itemizing on account of huge sell-offs. Equally, $MUBARAK and $PARTI adopted a well-recognized sample: a short pump pushed by pre-listing hype, adopted by a pointy dump as giant holders, or “whales,” liquidated their positions.

$TRUMP latest efficiency – Supply: Binance

This constant underperformance has led traders to query Binance’s vetting course of. Many now suspect the change prioritizes initiatives prepared to pay excessive itemizing charges over these with sturdy fundamentals. The notion that Binance has turn out to be a “dumping ground” for low-quality initiatives is gaining traction, with communities on X even launching hashtags like #BoycottBinance. Traders more and more understand Binance listings as a warning signal relatively than an endorsement, which stands in stark distinction to the change’s earlier repute.

Why Binance Listings Are Crashing Onerous?

A poisonous mixture of greed, market dynamics, and strategic missteps led to the catastrophic price drops of tokens listed on Binance in 2025. From sky-high itemizing charges to a meme coin obsession, right here’s why newly listed tokens are bleeding worth sooner than ever.

Sky-Excessive Itemizing Prices: Draining Tasks Dry Earlier than They Fly?

Binance’s itemizing course of isn’t only a pay-to-play sport—it’s a useful resource sink that may cripple initiatives. Securing a spot on the change calls for hundreds of thousands of {dollars} in charges, forcing initiatives to pour practically all their monetary and operational muscle into the itemizing itself.

This all-in wager leaves thinly backed initiatives, which lack strong backers or clear long-term methods, dangerously uncovered. That is exemplified by tokens akin to $MUBARAK and $PARTI, which skilled super hype throughout their pre-listing section and expended important sources to safe a spot on Binance. Nonetheless, their post-launch collapse occurred on account of weak fundamentals and stretched budgets that didn’t maintain development.

With no runway left to innovate or execute, these initiatives falter, their costs tanking—$MUBARAK alone plunged 70%—leaving traders burned and questioning if Binance is a springboard for achievement or a graveyard for overextended goals.

Binance’s Liquidity Entice: The Excellent Dump Zone

Binance, with its day by day buying and selling quantity usually surpassing $20 billion, is the popular vacation spot for initiatives looking for to money out. This excessive liquidity makes it the best “final stop” for whales and insiders to unload huge token provides, triggering brutal pump-and-dump schemes.

Take $MUBARAK, for instance: hyped pre-listing, it soared briefly earlier than crashing over 70% as giant holders dumped hundreds of thousands of tokens. Equally, coordinated sell-offs fueled $TRUMP’s 70% post-listing plunge, usually implicating market makers like Wintermute. Binance’s liquidity, as soon as a energy, has turn out to be a magnet for these predatory techniques, leaving retail traders as collateral harm.

Supply: TradingView

Different Causes to Kind a Recipe for Catastrophe

The broader crypto market in 2025 is a graveyard of confidence, amplifying Binance’s itemizing woes. The Concern & Greed Index has languished in Concern to Excessive Concern since January, reflecting retail traders’ retreat amid world commerce tensions, such because the spike in U.S.-China tariffs to 125%. Moreover, the liquidity drought makes new tokens simple prey for volatility spikes.

Supply: Binance

Worse, Binance’s obsession with meme cash like $TRUMP and $MUBARAK is spectacularly mistimed. The meme coin craze that fueled in late 2024 has fizzled in 2025’s bear market, with traders craving initiatives providing real-world utility. Binance’s failure to adapt to a market demanding substance over sizzle is torching its repute.

Different components embody aggressive sell-offs by market makers like Wintermute, as seen within the $ACT token dump, and modifications in tokenomics that erode investor confidence, akin to $OM’s provide enhance and inflation changes. These points, mixed with incidents just like the FDUSD stablecoin depeg, have fueled mistrust in Binance’s transparency and reliability.

Conclusion

The dismal efficiency of Binance’s latest listings has considerably undermined market confidence. To revive belief, Binance should prioritize high quality over amount in its listings and deal with considerations about transparency. Till then, traders are more likely to stay cautious, viewing Binance not as a launchpad for innovation however as a cautionary story of hype and disappointment.